BIS, Quant and BoE complete CBDC exploration project

An experiment exploring the use of APIs for central bank digital currencies (CBDCs) has been completed by its participating contributors: the Bank of International Settlements (BIS), Quant and the Bank of England (BoE).

BIS, Quant and BoE put CBDCs to the test

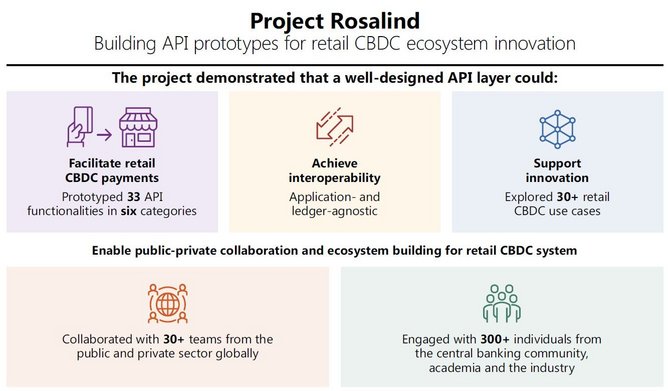

Named Project Rosalind, the API experiment was based on a two-tier model representing a public-private partnership. Technology provider Quant used a central API layer to connect public and private infrastructures, as involved parties addressed the need for a universal and extensible API layer for retail CBDC payments.

This model was used in collaboration with the private sector to understand the building blocks of a CBDC ecosystem and how APIs could support this innovation.

In a statement, BIS notes that the API layer developed has 33 endpoints in six functional categories, with the design and functionalities of each tested and validated in over 30 use cases explored with private and public sector collaborators.

The result? That APIs could work with multiple central bank ledger designs to facilitate payments, so long as the API layer’s design is consistent with the wider privacy model for a CBDC.

A step toward CBDCs in the UK

Martin Hargreaves, Chief Product Officer at Quant – the technology provider of Project Rosalind – sees the experiment as an important step toward digital currency being centralised in day-to-day life.

He says: “We’ve now created real-world examples of how CBDCs could be integrated into our day-to-day lives. Each participating company suggested a few different use cases to test, and we worked to add innovations to the core of each suggestion.

"This collaboration meant we could create a lot of high-impact applications of CBDCs through our approach of implementing novel ideas and programming each use case uniquely.

“For example, one firm demonstrated a checkout experience whereby the customer could select and use a CBDC to pay for an item (similar to selecting and using a debit card, or Apple Pay), while a major bank completed an example transaction between a parent and their child’s account, whereby the child was paid an amount from their parent’s account once certain chores had been completed.

“The project has shown a wealth of examples where CBDCs can be used in – and add value to – our lives."

Quant’s Founder and CEO, Gilbert Verdian, highlights the value of CBDCs in “the fight against fraud”.

He adds: “CBDCs will equip central banks and commercial banks to tackle the fraud and financial crime challenges we have today with a new approach and technology. Fraud is constantly evolving and the tools and infrastructure we’ve been using to tackle fraud can’t keep up.

“CBDCs present an opportunity to embed fraud protection at the network level and provide a holistic view of transactions to better spot patterns of fraudulent behaviour.

“CBDC has logic and can embed fraud checks into the transaction; this means that if you make a payment, the currency will assess the transaction and the recipient before the money moves to provide the ability to have a higher baseline level of fraud protection at the network level – rather than moving the money immediately and then you realise you’ve been scammed.”

Further CBDC exploration needed

While the results of Project Rosalind appear positive for the eventual introduction of CBDCs, BIS notes that further avenues of exploration should first be tread.

One such route is exploring ways APIs can support offline CBDC payments, and the challenges involved in delivering offline functionality.

Other areas of suggested investigation include how an API might allow the ecosystem to share user and payment data in a way that preserves privacy.

For BIS, defining the trade-off between extensibility and consistency, and the operational roles and responsibilities of participants in the ecosystem, is an imperative step to take on the path toward CBDCs entering circulation.

- Top 10: Fintech Accelerators and IncubatorsVenture Capital

- Worldpay from FIS Partners With Liberis for SME FundingFinancial Services (FinServ)

- WEF and Cambridge University Unveil Future of Fintech ReportFinancial Services (FinServ)

- Why Recurly is Trusted by Industry-leading OrganisationsFinancial Services (FinServ)