Why Big Tech is Driving the Fintech Digital Ecosystem

Big Tech first pioneered the concept of business ecosystems to monetise its technology platforms and customer relationships. Ecosystem-based strategies are primarily collaborative models, set up with the knowledge that no business by itself can address all the needs of its customers, and a collective of businesses is much better-positioned to do so — especially in a digitally disintermediated world.

This is the view of CEO Nanda Kumar of SunTec, the world’s no.1 pricing and billing company, which specialises in creating value for enterprises through its cloud-based products.

Kumar believes the benefits of an ecosystem are multiple and can vastly improve brand health for the financial services industry.

“A recent survey carried out by Deloitte Consulting AG and The Ecosystems Competence Centre of the Business Engineering Institute, St. Gallen, concluded that by 2025, about 30% of the revenues in the financial services industry will be generated in cross-sector ecosystems,” he said.

Kumar added: “More than half of respondents said their businesses are already offering services as part of ecosystems, and three-quarters of the respondents expect to be active members of an ecosystem within the next three years. A 77% majority believes that “ecosystems will have significant importance on the future growth of their business.

Banks and ecosystems

Joanne Dewar, CEO of Global Processing Services (GPS), said: “I think that the banks that turn out to be the winners are going to be the ones that learn to partner with the wider ecosystem, because they don’t need to do everything themselves.

Banks that really understand how to leverage that same partner network are going to be those that are able to maintain the agility that’s going to be needed going forwards, not just for the needs of today and tomorrow, but well into the future,” said Dewar.

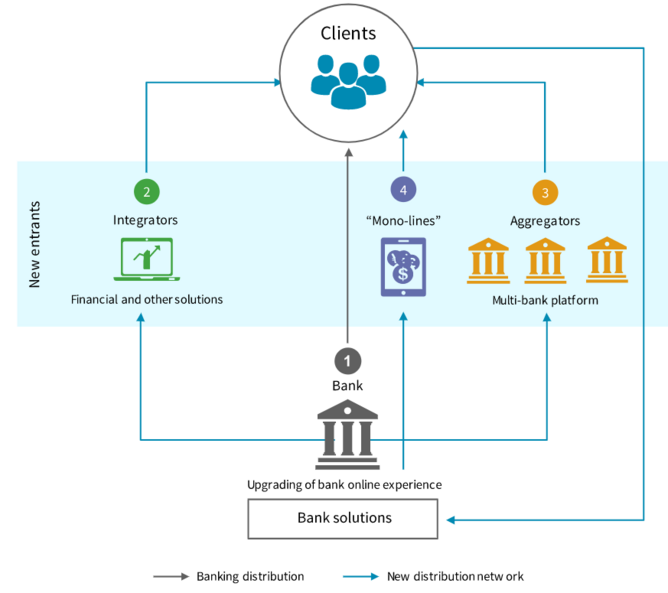

According to Kumar, banks specifically can reap the rewards of a strong and effective ecosystem, as an ecosystem-centered strategy can enable banks to improve their customer experience delivery, remain competitive — especially with the ever-greater threat from neo-banks and fintechs — and drive growth.

“Strategies by banks such as “Banking-as-a-Service” (BaaS), “Open Banking” and “Platform Banking” are a step towards an ecosystem play. However, it is not enough to take on well-entrenched first movers like Amazon and Google, whose powerful, proven technology platforms are capable of not only delivering superior customer experience, but also enabling easy onboarding of new members into the ecosystem.

“In the past, proprietary systems were a source of significant value to banks; but going forward, their competitive edge will depend on rapid deployment of secure, scalable technology platforms that spur collaboration, customer-centricity and innovation to deliver higher levels of business experience to customers. Platforms must be able to attract and retain both partners who provide goods and services, as well as customers”, said Kumar.

For banks that want to co-create ecosystems with other businesses, Kumar suggests the focus must be on “building stronger brands, refining business models and strengthening operational capabilities to deliver superior business experience to customers. This builds customer loyalty which, in turn, will enhance and sustain growth,” he added.

Removing the pain point of traditional banking

Neri Tollardo, Director of Strategy at Tinkoff, branchless credit card monoliner from its inception in 2006, today is more like a tech company with banking and brokerage licences. It serves more than 20 million customers with a full range of financial and lifestyle services via its digital ecosystem.

A key part of their internal ecosystem, according to Tollardo, is Tinkoff Bank, one of the most profitable digital banks globally and the first financial institution in Europe to launch its own super app. Aided by artificial intelligence (AI) and machine learning (ML), the award-winning super app enables customers to tap into what’s most relevant for them.

“The app helps customers assess and plan personal spending, invest savings, earn loyalty programme bonuses, book trips, buy movie tickets, make restaurant reservations, and carry out other spending-related tasks all in one place,” said Tollardo.

The Tinkoff ecosystem also includes services for businesses, such as Tinkoff Checkout — a one-stop-shop for merchants of various sizes to accept payments and use a full range of acquiring services. The solution is customisable and works “as a Lego set, where each business can assemble the pieces that fit its needs best,” said Tollardo.

Tinkoff Checkout already serves 100,000 customers and placed 16th in The Nilson Report’s ranking of the Top 25 largest acquirers in Europe.

“Our approach is simple. We aim to address the pain points of traditional banking and brokerage sectors by providing a market-beating digital user experience for both individuals and businesses,” concluded Tollardo.

Tinkoff’s success is rooted in its own technology. Top software engineers, data scientists and financial professionals are part of 7,000 employees, with more 80% of these employees focused on tech.

Siloes must be removed

James Harrison, Head of UK, Telstra, thinks that in order to build and sustain digital ecosystems, company culture must take centre stage.

“Purposeful transformation, secure business practices, and patterns of successful behaviour, all depend on organisations removing silos and making efforts to foster a culture which values collaboration between people, technology, and industry.

“All too often the focus is put entirely on the technological side of digital transformation instead of on the people using the technology and the culture they operate within. By aligning business practices with a positive and open company culture, organisations can design digital ecosystems with people at its core. In doing so, organisations can create an optimised environment, designed to create enduring positive change, where your people, not technology, are your prized asset,” said Harrison.

Harrison believes that a failure to align with culture, employee values and behaviours can create disjointed digital ecosystems. Whereas, “a collaborative, people-centric approach can help shift the culture to understand, embrace and advance digital ecosystems, transform how partners and customers view the business and help attract and retain talent,” he added.

Ecosystems are based on trust

Emily Heath, SVP, Chief Trust & Security Officer - DocuSign, said: “The swift onset of mass digital transformation initiatives means every organisation is greatly expanding the ecosystem of companies connecting with it. Each has their own unique set of requirements when it comes to security, and more often than not, security is only as strong as the weakest part of that ecosystem,”

Acknowledging trust ultimately gives business a competitive advantage. Heath says there are three golden rules should be considered when identifying the strength of trust within any ecosystem:

- Know your vendors’ security postures. This includes the ongoing sharing of details, including vulnerabilities. This transparency strengthens the bonds of trust within the ecosystem and improves its overall security.

- Know your vendors by name. Being able to lean on a personal relationship when something goes wrong makes it much easier to work through challenges collaboratively. Coming through adversity builds trust.

- Combine real-time intelligence tools with the soft skills of relationship building to rank each of your vendors. Spend time educating those struggling to deliver, and interconnect your vendors for knowledge sharing when it makes sense.

Heath added: “Ultimately, trust is about people. Devising a strategy that assigns equal parts trust and security is the key to achieving safer environments. Although never completely eliminating the risk, trust is about individuals; based on what you do and who you are while doing it. That’s a true competitive differentiator.”

- Hong Kong’s FundPark Lands US$250m in Goldman Sachs BackingVenture Capital

- Sumsub: Identity Fraud up 73%; how can Fintechs React?Fraud & ID Verification

- Money20/20 USA: Convera Talks FX Volatility for BusinessesFinancial Services (FinServ)

- Mastercard: Supporting B2B Healthcare With Payments SolutionFinancial Services (FinServ)